Hello hello! For me, travel is a passion. I feel that travel is something everyone should experience without limitation. Some people completely shy away from travel opportunities under the assumption it is way out of their budget. This does not have to be the case. There are tricks and hacks that can help you avoid spending loads of money on traveling.

My main goal with this guide is to relay the information about travel hacks and credit card points to help people travel for cheap and, in some cases, completely free. If you are reading this, you love to travel and save money, so why not both? This really will change the way you travel.

My best credit card points win was the honeymoon me and my wife, Kirsi, took to Hawaii. I haven’t done the exact calculations, but it was easily over a thousands dollars of flights and hotels all paid for by credit card points we accrued from just our daily spend. The Southwest Companion Pass (companion flies free) got us from Atlanta to Kauai to Maui and back. Then, our points covered all eight nights staying on the two islands. A story like this isn’t to brag. It is to show you what you can also get in this game of points and miles.

Everyone is coming into this at different levels. The seasoned traveler who has dabbled with a few credit cards or someone who just paid cash for an overpriced flight. No matter what, this basic information will change your travel strategy completely. The only thing I ask in return is to use the referral links provided on my Best Credit Card Page! I want to continue to be a resource and write about other topics that you want to know about. Let’s make this into a great community!

I broke this guide down into sections in an attempt to answer all questions you may have and also navigate you through the decision making process of opening a credit card. Alright, let’s get into it.

DISCLAIMER

Please, please, please do not get into this hobby if you are irresponsible with credit cards. There are situations where people sometimes need to rely on credit cards to pay for unforeseen emergencies and that is ok. However, I would highly recommend paying down all current credit card balances before getting started. The Cardinal Rule of credit card points is to pay off credit card balances on time and in full each month.

DO CREDIT CARDS HURT MY CREDIT SCORE?

The first question I always get is, “Won’t this negatively impact my credit?” In the short term, yes it will but not in the long term. Your credit score will go down after a “hard pull” when applying for the credit card but will only go down shortly. After paying off your credit card balance, it will improve to a number better than your original score.

Your Credit Score is based on: Payment history | credit card use | derogatory marks | credit age | total accounts

The high impact categories are your payment history, use, and derogatory marks. Basically, if you make your payments on time and don’t carry a balance, you will score well in these categories. What is of lesser importance is the number of accounts. That means you can open a credit card or two and not have your score impacted a great deal. Personally, my score has gone up about 60 points from a 730 to a 790 over the past years since starting this game of points and miles. That is with student loans, a car loan, and a mortgage (American Dream babyyy). This hobby really can be for everyone.

Main Factors to Consider in Travel Hacking

Must hit the Minimum Spend

This is the most important thing to remember about all of the suggestions moving forward. You must be able to hit the spending bonus when you open up the credit card. It is not fully worth it if you do not. Either $4K in three months or some of the crazy ones that are $15K in six months, you must be able to spend that much to get the sign-up bonus. That is where the value is. It is more manageable than you think if you put all of your everyday spend on to one credit. Again, just make sure you pay it off in full each month.

Transferability

Another crucial factor is to make sure the points you earn transfer between travel partners. For example, Chase Ultimate Rewards and American Express Membership Rewards transfer to most hotel chains and airlines. However, Marriott points do not transfer to United Airlines. This makes it important to earn and collect points that are transferable over many options. So, you could open the new Chase card, hit the bonus, then transfer however many points you need to Hyatt for your stay. This little piece of information can save thousands of points in redemptions.

Annual Fees

Annual fees associated with some credit cards are the part that scares off many people from credit cards. It is never fun to have the annual fee hit your account, however, it is not something that should deter you.

Many annual fees on the card pays for themselves. There are cards with a low $95 annual fee and then there are premium cards that have $500-$600 annual fees. As eye-popping as that is, there are perks that make you get most of that money back. I will go into the specifics of that in my card breakdown later on, but annual fees are something to determine first what you are comfortable with. The basic Marriott card has a $99 annual fee that may pay for itself because of their anniversary free night. This is not too bad price compared to the monster $550 annual fee of Chase Sapphire Reserve fee. It is all up to how much value things will be to your preferences.

Credit Card History

Another factor to consider is what credit cards you currently use now and which type of points or miles you have. If you already have a good amount of Delta SkyMiles, then you could be better served opening a hotel branded credit card. Or on the flip side, if you travel for work and have a ton of Marriott points, then maybe you can look at airline cards or more general cards with transferable points.

Not all Points are Created Equal

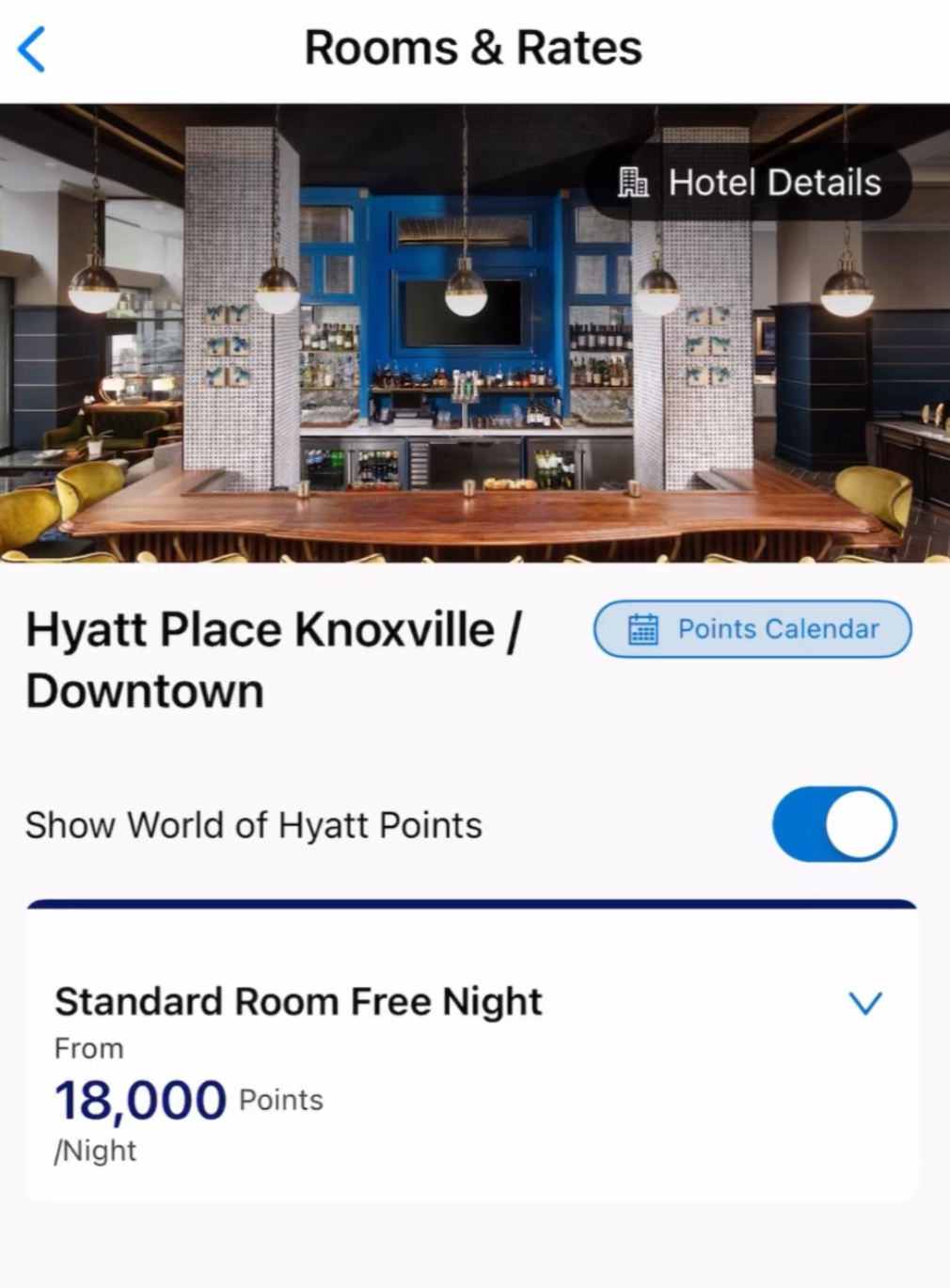

This transferability aspect then rolls into the next factor. That is that not all points are created equal. This means that different companies will value their points differently than their competitors. A trip from Atlanta to Los Angeles on Delta is going to be thousands of more SkyMiles than it would be with Southwest Rapid Reward Points. It is the same dollar value, just a different currency with their airline point system. Similar to hotels, you will see IHG value their rooms at different point values than Hyatt. This won’t affect much in the intro period for you, but it will make you reconsider spending Chase points towards an IHG stay compared to Hyatt if they are all a one-to-one transfer.

Opening The Card

Now, after getting through all those important factors to consider, you are ready to start thinking about opening a travel credit card. There are many different ways of thinking about this.

The main two questions to ask should be:

1. Are you opening a card for a specific trip?

2. Or are you just accruing points that can help you plan a trip down the road?

These two questions will be a great starting off point into your journey with credit card points and travel hacking. I will go through and address the different ways to go about each question.

For a Specific Trip

Congratulations! You have that travel bug and picked a destination. Now, the goal is to find a cheap way to get there and stay there, so you can spend your money on what matters most- food.

I would say to first start with finding flights. This will be a bit harder because of the amount of time it may take to hit your signup bonus. It will make more sense below, but you want these points to be transferable. That gives you options to purchase these flights when they come available.

Next, if you see a cheap flight come across your radar, try and jump on that as soon as possible. That is where the most volatility will be. Flights prices go up and down all the time without much advanced notice. If you follow sites such as Scotts Cheap Flight, now Going, or Thrifty Traveler (Ask me more), these will notify you when the flights are the cheapest. Then, you take that flight you find and go to book with points through that bank or airline portal.

For example, one of my first cheap flight wins was a price drop from Atlanta to Paris for $400 roundtrip. We received that notification and jumped through the Chase portal to book the flight with points from a recent signup bonus that we earned. For the two of us, it was just over 63,000 points. $800 of value for one signup bonus.

Then, you would look for hotels, the hotels are second to think about because the point values do not change. They are based on categories set by the hotel companies. Because of this, you have the time to find the perfect Marriott property in Hawaii, then build up signup bonuses to cover the nights that are available. Find the hotel, then build up the points specific to this trip.

Many travel blogs you may read do not support this way of doing the credit card game. I have always disagreed with that because you are going for the goal of where you want to go. If you are traveling to the Bahamas and know it takes a certain amount of United miles for the flight and Hyatt points for the hotel, by all means go after that. Targeted trips make for a purpose in what you are building with your points. The most important part is to travel and using those points to do it.

Accrual Over Time

The other option (or an idea if you aren’t currently wanting to travel) is accruing points over time. This strategy is selecting cards based on the best bonuses to have points when the time comes to travel. I recommend this to most everyone who isn’t planning for a trip. This is opening the Chase Sapphire Preferred or the Capital One Venture X because they have solid bonuses and are transferable to many different options. Gaining points is the name of the game to be ready if a trip presents itself. You already have the points, so there is no reason to say no to that trip of a lifetime.

All of this is important to think about before deciding which direction to go. It is overwhelming at times which is why I created a post of my Best Cards sectioned by category. Ultimately, this will be your personal preference, but these are some of the premier cards that anyone in the business would recommend. It is not going down a line and selecting the biggest bonuses. Instead, I very much recommend planning a strategy and wanting to open cards based on those goals. I am open to helping plan that strategy as well.

This is just the beginning of a whole new world of Travel Hacking. There’s even more to come on the site such as the Two Player Game, Southwest’s Companion Pass (best perk in the game), Hotel Room Upgrade Emails, Airline redemptions, Category spending, etc. These are all topics that I will be diving deep into with posts on this new website.

Ultimately, what is in this Guide is only the basics. When I originally came across this information, it was mind blowing the amount of depth there is to this game of points and miles. I still have loads to learn, but I am to the point where I want to share this with everyone. Everyone is reading this with that same idea. Free travel.

The goal is to be a version of a travel agency but based on credit card points and miles. Instead of booking trips for people, I can help you out finding the best value locations and destinations and what credit cards to get you there.

Please let me know if there are any questions or comments with any of this information. I am always here to help.

Adventure is out there!