Is Opening New Credit Card Accounts Bad for Your Credit Score?

In short: No!

Opening new credit card accounts does not have a long-term negative impact on your credit score. The real issues arise from reckless spending and carrying high balances on multiple cards. Missing payments or maxing out your credit limit can harm your credit score significantly.

If you struggle with debt or frequently miss payments, it’s best to delay diving into the points and miles game until you’ve cleaned up your credit habits.

The Truth About Credit Cards and Your Credit Score

Many people believe credit cards are inherently bad and only using a debit card prevents overspending. While overspending is a valid concern, this mindset oversimplifies the role of credit cards.

When you open a new credit card, your score might temporarily drop a few points due to a hard inquiry. However, this drop is short-lived, and your score will typically recover—often higher than before—if you maintain good habits like on-time payments.

Understanding Credit Score Factors

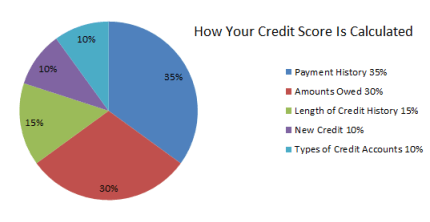

To navigate the points and miles game responsibly, you need to understand the five factors that impact your credit score:

1. Payment History (35% of Your Score)

Payment history is the most significant factor. Making your payments on time and in full is crucial to maintaining and improving your score.

- Pro Tip: Set up autopay on all your cards to avoid missed payments.

- Missing even one payment can significantly harm your score, so staying organized is key for success in travel hacking.

2. Credit Utilization Rate (30%)

Your credit utilization rate is the percentage of your available credit that you’re using. This is calculated by dividing your total balances by your total credit limit.

- Goal: Keep your utilization rate below 30% (ideally below 10%).

- Opening multiple cards with low balances can help lower your utilization rate, boosting your credit score over time.

3. Length of Credit History (15%)

The longer your credit history, the better for your score. Your first credit card plays a critical role in this factor.

- Never close your oldest credit card account. If it has an annual fee you no longer want to pay, consider downgrading it to a no-annual-fee card.

4. Credit Mix (10%)

This factor considers the variety of credit types you have, such as credit cards, mortgages, or student loans. While having a diverse credit mix can help, it’s a minor factor and not worth taking on unnecessary debt.

5. New Credit (10%)

Every time you apply for a new credit card or loan, it results in a hard inquiry on your credit report. This can temporarily lower your score by a few points.

- The good news? Your score typically rebounds within a few months, especially if you continue making on-time payments.

Comfort with Credit: The Key to Success

Before diving into the world of travel hacking and credit card rewards, ensure you’re comfortable managing your credit. Tools like Credit Karma and Mint can help you monitor your score and identify areas for improvement.

For example, my own journey began with a 720 credit score. After responsibly opening credit cards and managing my spending, my score has risen to the 790-800 range.

As the Points Guy often says, “A small dip in your credit score is a small price to pay for unlocking sign-up bonuses worth $1,000 or more in free travel.”

Final Thoughts: Credit Cards Are Tools, Not Threats

Credit cards aren’t inherently bad; they’re tools that can unlock incredible travel opportunities if used wisely. By understanding and managing the factors that influence your credit score, you can confidently participate in the points and miles game.